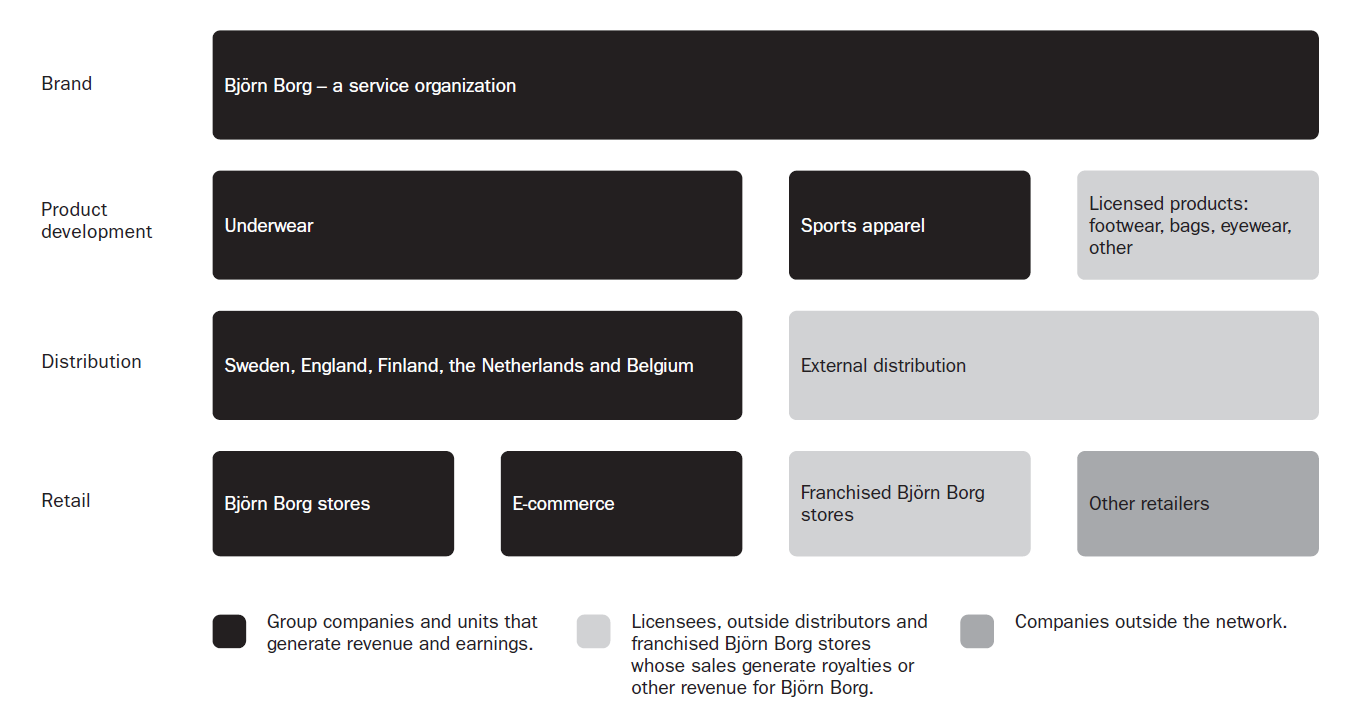

The Group’s stable profitability and the successful positioning of the Björn Borg brand largely originate from the business model, which facilitates a geographical and product expansion with limited operational risk and capital investment.

Björn Borg’s business model utilizes the Group’s own companies as well as a network of external distributors and licensees, who on the basis of a license from Björn Borg manage a product area and/ or a geographical market. The network also includes Björn Borg stores operated either by the Group or by external distributors or franchisees.

Björn Borg owns strategically important operations at every level of the value chain, from product development to distribution and retail sales. Underwear, Sports Apparel and bags External distribution Sweden, Finland, the Netherlands, Belgium, Germany and Denmark Björn Borg stores E-commerce Other retailers Product development Distribution Retail Brand Björn Borg – a service organization

Licensed products

Footwear, eyewear, other Franchise Björn Borg stores Group companies and units that generate revenue and earnings. Licensees, external distributors and franchised Björn Borg stores whose sales generate royalties or other revenue for Björn Borg.

Companies outside the network

Through the business model with a network of its own units and independent partners, Björn Borg is able with a relatively small organization and with limited financial investments and risks, to be involved in key links of the value chain and develop the brand internationally. The part of the business model which relies on external partners is relatively capital efficient for the company since the external licensees and distributors in the network are responsible for marketing, including investments and inventory in their respective markets. This model, which combines in-house operations with independent partners, generates substantial consumer sales with limited risk and investment for Björn Borg.